One of the biggest changes is to the province's Property Transfer Tax. Beginning April 1, 2024, the exemptions will expand, benefitting both first time home buyers, new-home buyers for their primary residence purchase.

What is Property Transfer Tax (PTT?)

Whenever property transfers ownership in BC, it is subject to a tax called PTT, unless the transfer of ownership qualifies for one of the exemptions offered by the provincial government. Property transfer tax is paid at the time of property registration with the Land Title Office. Usually, your lawyer or notary will arrange the payment as part of the closing/adjustments process. If you are wondering if you can utilize your mortgage to pay the PTT, you should seek advice from your lender/lawyer as generally, PTT isn't incorporated into a mortgage and needs to be paid upfront at the time of the property transfer.

How Much is PTT?

Property ownership transfers are taxed as following:

- 1% of fair market value up to and including $200,000

- 2% of the fair market value greater than $200,000 and up to and including $2,000,0000

- 3% of fair market value greater than $2,000,0000

- An additional 2% tax will be added to the residential property value over 3,000,0000

Property Transfer Tax Exemptions For Residential Home Buyers (Expanded Exemptions Beginning April 1, 2024)

First-Time Homebuyers’ Exemption (After April 1, 2024)

The threshold to be eligible for the first-time homebuyers’ exemption is now $835,000, with the first $500,000 exempt from the tax. The phase-out range for the complete elimination of the exemption will be $860,000, while properties with a fair market value under $500,000 will be completely exempt.

This means eligible first time home buyers will see savings of up to $8,000

Newly-Built Home Exemption

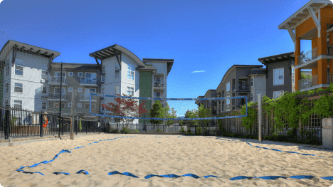

There is a lot of new construction in the Kelowna and Okanagan area so the increased Newly-Built Home Exemption for new homes used as the Primary Residence is welcome news. Qualifying purchasers of newly constructed homes will be exempt from PTT on home purchases with a fair market value of $1.1 million or less, with a partial exemption being available for newly built homes with a fair market value between $1.1 million and $1.15 million. This exemption covers a wide variety of new condos and townhomes, and some local Single Family homes will also qualify based on price.

Purchasers will see a savings of up to $20,000

Key Takeaways For Residential Buyers

The changes announced to the PTT exemptions offer expanded opportunities for prospective purchasers and sellers in British Columbia, and are more in-line with our current market values.

Specific tax exemption requirements can be challenging to navigate. You can learn more at the Government of BC's website but you should always get legal advice pertaining to your purchase from your lawyer.